SHANGHAI, China — Alibaba just made e-commerce history. With the company's massive Singles' Day celebration on 11/11 — November 11 — coming to a close, Alibaba reports that customers spent $30.8 billion online over the last 24 hours. That is a significant increase from the $25.3 billion in gross merchandise volume (GMV) Alibaba shoppers spent…

ON THE campaign trail, Imran Khan, Pakistan’s new prime minister, presented himself as the man to break the country’s addiction to hand-outs from the West. Whereas previous governments used to go begging to the IMF for funds, he said, his Pakistan Movement for Justice (PTI) would focus instead on recouping billions of dollars hidden from…

WASHINGTON (Reuters) - The U.S. Federal Reserve raised interest rates on Wednesday and left intact its plans to steadily tighten monetary policy, as it forecast that the U.S. economy would enjoy at least three more years of growth. In a statement that marked the end of the era of “accommodative” monetary policy, Fed policymakers lifted…

Guillaume Payen/SOPA Images/LightRocket via Getty Images In recent weeks, both Uber and Airbnb have sent formal letters to the Securities and Exchange Commission, asking the regulatory agency to expand efforts that would allow drivers and hosts to also be paid in company shares. Exactly how this would work in practice remains unclear. The move comes…

Paulo Whitaker/Reuters US equity markets were under pressure Thursday as the 10-year yield touched its highest level since the spring of 2011. Selling weighed heaviest on the tech-heavy Nasdaq, which saw losses in excess of 2%. Super Micro Computers crashed more than 50% after it was reported that Chinese spies implanted tiny chips in server motherboards…

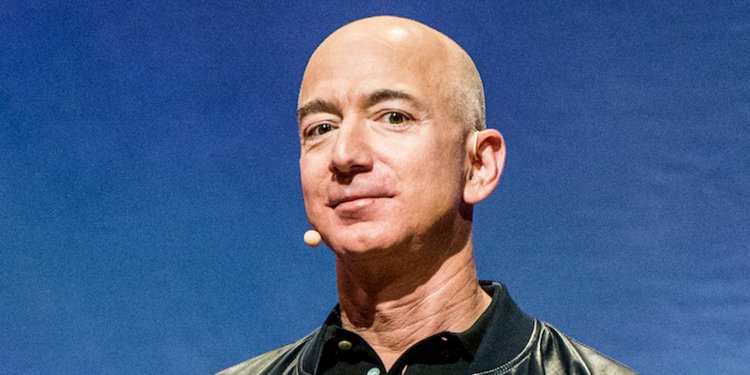

The long wait is apparently almost over. Amazon is said to be in talks to develop its second headquarters, HQ2, in the Long Island City section of Queens, New York, and the Crystal City area of Arlington, Virginia, The New York Times reported on Monday evening, citing people familiar with the plans. The decision follows…

TOKYO (Reuters) - Wall Street stock futures and Asian shares lost steam on Wednesday after Democrats won control of the U.S. House of Representatives, boosting the party’s ability to block President Donald Trump’s political and economic agenda. People walk past an electronic board showing Japan's Nikkei average outside a brokerage in Tokyo, Japan, October 12,…

WASHINGTON (Reuters) - The United States reimposes oil and financial sanctions against Iran on Monday, significantly turning up the pressure on Tehran in order to curb its missile and nuclear programs and counter its growing military and political influence in the Middle East. FILE PHOTO: Iranian rials, U.S. dollars and Iraqi dinars are seen at…

By CHRIS CIRILLO | Nov. 28, 2017 | 1:57 A handful of Republican senators are on the fence about President Trump’s tax plan. Here are their concerns. Related: article: Senators Scramble to Advance Tax Bill That Increasingly Rewards Wealthy

Amazon has finally, officially made a decision. The company on Tuesday announced it would split its second-headquarters project, which it calls HQ2, in two. The two locations — the Long Island City neighborhood of Queens, New York, and the newly formed National Landing area of Arlington, Virginia — will each get roughly half of the…